Corporate Buybacks Slowing to a Crawl in 2023

Corporate Buybacks Slowing to a Crawl in 2023

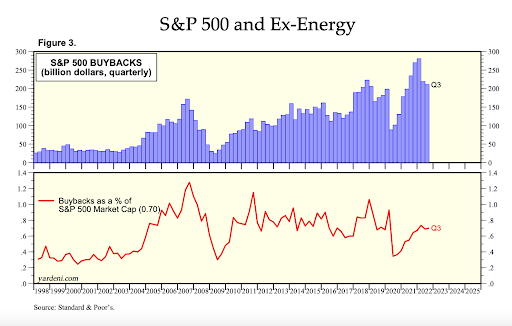

Buybacks had already started to slow in 2022 before the law went into place.

According to S&P Dow Jones Indices, buybacks reached $981.6 billion over the 12 months through September 2022. By comparison, buybacks had reached a record $1.005 trillion posted for the 12 months through the June 2022 period.

Source: Yardeni Research

Source: Yardeni Research

Buybacks started to slow in Q2 of last year when interest rates started to rise. With rates poised to increase three more times this year, it’s hard to see how and why companies would ramp up buybacks in this environment.

Analysts continue to expect aggressive buybacks to reduce exposure to declining earnings in the year ahead. Come March, they anticipate that Apple will INCREASE its buyback program. That’s a huge bet, and something that I think could surprise the downside.

This year's focus is heavily on the Fed’s balance sheet reductions and rate hikes. But one of the stories remains the impact of lower buybacks in a higher-rate environment.

This is the under-the-radar trend that can push S&P 500 earnings multiples lower…

A cut in buybacks here, a reduction in bricks from a wall there. Eventually, the foundation for a very bullish factor starts to crumble. Investors need to prepare for a downtrend.

Government meddling and taxation will kill the market

“Corporate buybacks – a major catalyst for the bull market since the Great Financial Crisis – will likely be dramatically reduced going forward because of a new 1% excise tax on them taking effect on Jan. 1, as well as corporations no longer being able to issue almost cost-free debt (like they had been able to for several years) to finance those buybacks”.

Comments

Post a Comment